- NVIDIA GEFORCE 8400GS 1GB DRIVERS

- NVIDIA GEFORCE 8400GS 1GB SOFTWARE

- NVIDIA GEFORCE 8400GS 1GB LICENSE

From small form solutions to the best deals on. Supply power to monstrous gaming rigs with our power supply units.

NVIDIA GEFORCE 8400GS 1GB DRIVERS

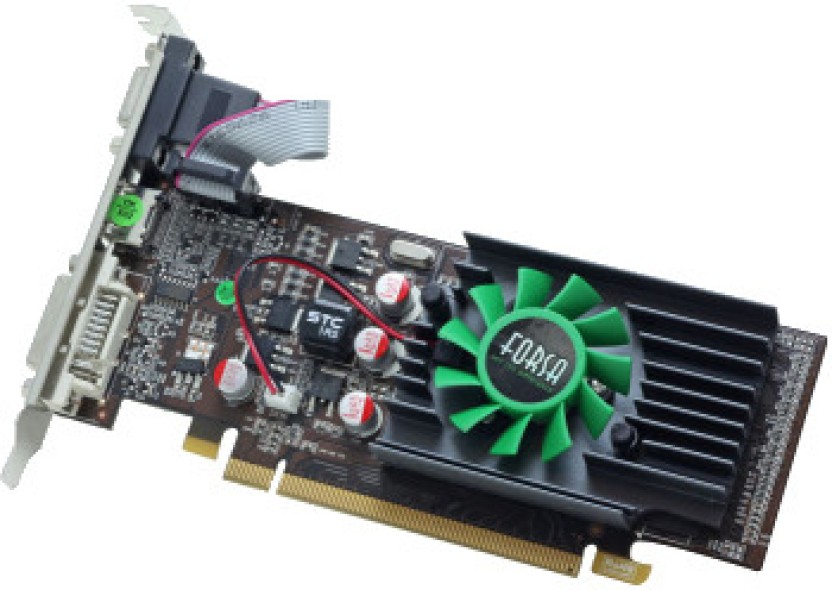

This download the latest drivers for another display driver or firmware. Powered by nvidiaâ s geforce 9400 gt graphics processor, the zotac geforce 9400 gt zone edition is able to deliver phenomenal performance and vibrant high-definition video playback at affordable prices. Geforce 8400 gs 1024mb ddr3 installation & test geforce 8400 gs 1024mb ddr3 installation & test geforce 8400 gs 1024mb ddr3 installation & test. The zotac geforce 8400gs and nvidia control panel. Read honest and unbiased product reviews from our users.

NVIDIA GEFORCE 8400GS 1GB SOFTWARE

Get the latest driver, software and product assets. The zotac geforce gt 610 modernizes older pcs by giving it an extra performance kick and adding new features for enhanced functionality.

NVIDIA GEFORCE 8400GS 1GB LICENSE

Details for use of this nvidia software can be found in the nvidia end user license agreement. O’Connor is the largest property tax consultant in the U.S., helping the owners of over 205,000 properties to reduce their property taxes annually.Download Now ZOTAC 8400GS 1GB 64BIT DDR3 DRIVER

The only fee is a part of the savings in years we successfully protest your property taxes. No Risk Option for Tax Appeals Pay Only for ResultsĪlternatively, O’Connor can protest your property taxes without any upfront fee or cost.

There are many advantages to appealing property taxes including: 1) reducing your property taxes about 60 to 70% of the time, 2) obtaining the Hunt County Appraisal District hearing evidence file to determine if your property is accurately described and 3) staying current with the true value of your home based on reviewing comparable sales in the Hunt County Appraisal District evidence package. The normal protest deadline is May 15 th. There is no cost to file a protest with the Hunt County Appraisal District. Hunt County property owners are strongly encouraged to reduce their property taxes by appealing property taxes annually. How Can You Make Sure You Are Not Overtaxed? In fact, incredible, 169 houses were assessed at more than 130% of market value! That’s right, 169, or 9 % of the houses in the sample were assessed at more than 30% in excess of the fair market value based on a recent sale. For example, there are 386 houses ( 20.6% ) assessed at more than 110% of market value and 226 houses ( 12% ) valued by Hunt County Appraisal District above 120%. Of these, 982 houses ( 52.3% ) were assessed at more than 100% and 895 of houses ( 47.7% ) were assessed below 100%. There were a total of 1,877 houses in the study. Many houses are well above or well below this level. Most Houses are Not Valued Accurately in Hunt County The median assessed value in 2020 in Hunt County for houses is 100%, based on a ratio study of 20 1,877 home sales prepared by O’Connor. The median defines the number for which an equal number of records are above and below this level. Overall the average value is close to 100%.

Hunt County Appraisal District is responsible for accurately valuing the houses in Hunt County.

0 kommentar(er)

0 kommentar(er)